China EXIM Bank has completed Sri Lanka Bilateral Debt Restructuring?

What can be gleaned from Sri Lanka's MoF reports

Without much fan fare, China EXIM Bank seems to have completed the restructuring of 39 bilateral loans to Sri Lanka following the signing of the MoU on 26th June 2024. Only reason we know this to be case is due to small footnotes in the June 2024 Debt Bulletin of the Sri Lanka Ministry of Finance. There is also evidence in the MoF’s external debt disbursement report for Jan-Jul 2024 that China EXIM Bank provided about $200mn in refinancing for 39 loans.

What’s the amount restructured?

At end-June 2024, the Debt Bulletin notes that $4187mn was outstanding to China EXIM Bank (ChEXIM), including $5.5mn in unpaid principal. A footnote to the relevant table notes that 39 loans were restructured with effect from 01 January 2024. This likely implies that ChEXIM applied the restructuring taking into account arrears accrued up until end-2023. Thereby ChEXIM also completed the restructuring within the 2-year debt moratorium it granted to Sri Lanka for 2022-2023.

In the March 2024 Debt Bulletin, ChEXIM was owed $3993Mn, including $903.8Mn in unpaid principal. Therefore, its clear that the unpaid principal has been capitalized and added back on to the restructured loans, with no principal haircut as expected. The increase in the outstanding amount to $4187mn by the June Bulletin likely implies that about $200mn in accrued unpaid interest arrears was also capitalized on to the principal amount.

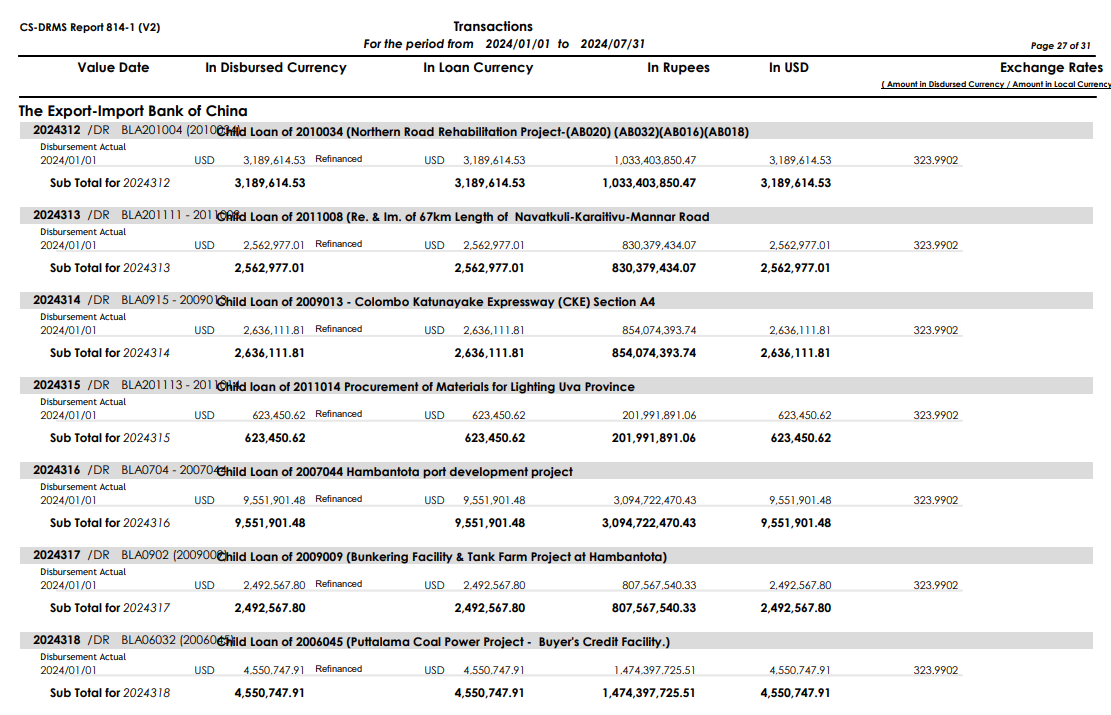

Entries corresponding to ~$200mn in total are visible in the Sri Lankan Ministry of Finance external disbursements report for Jan-Jul 2024. There are 39 individual entries for 39 different loans labeled as refinanced with effect from 01 Jan 2024. Therefore, we can I think confirm with some confidence that about $200mn in accrued interest arrears has been capitalized on to these 39 restructured loans.

Do we know the maturity structure of the new restructured loans?

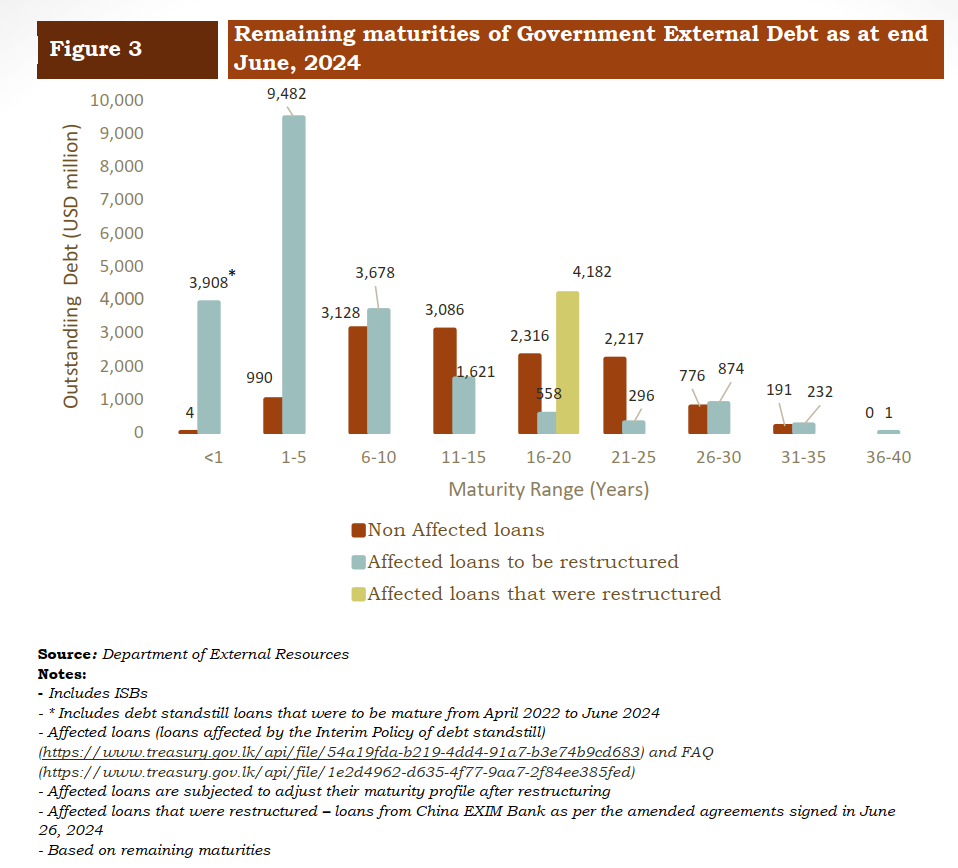

The June 2024 debt bulletin also provides the maturity structure of the external debt at present, which clearly shows the restructured ChEXIM loans falling within the 16-20 year maturity bucket (the green bar). The other debt that is still pending restructuring is in the blue bars and the multilateral and Indian emergency loans not being restructured are in the brown bars.

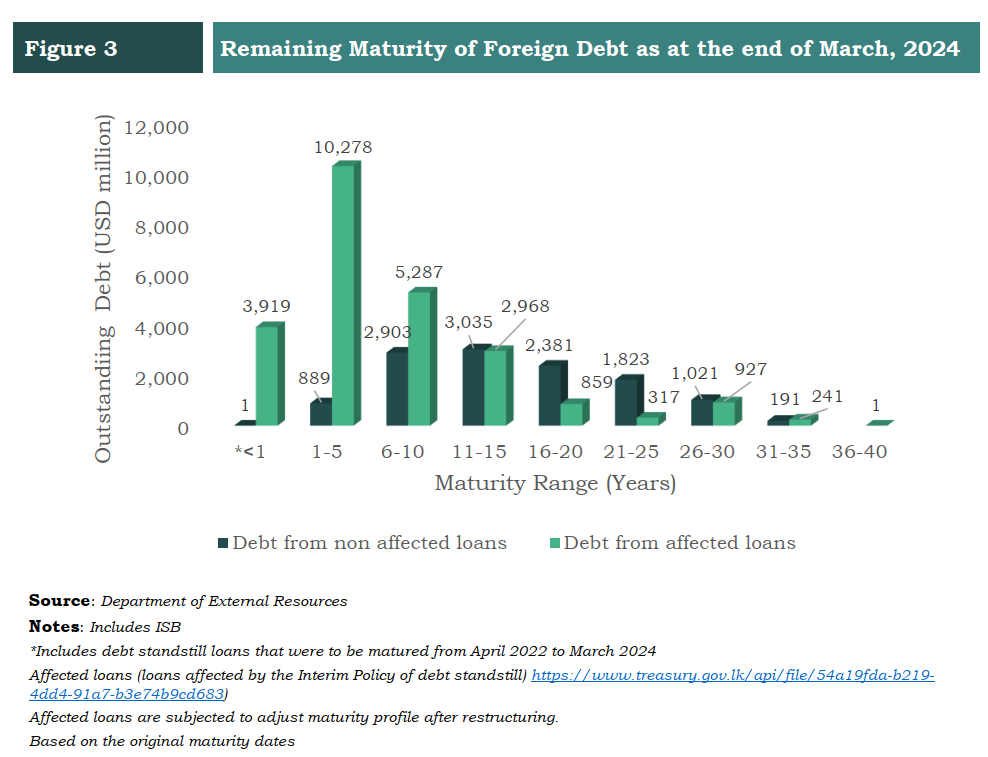

To understand how much of a maturity extension the ChEXIM loans might have gone through we have to take a look at the same maturity chart in the March 2024 Debt Bulletin. Its clear from the difference between the two charts that most of the ChEXIM loans would have moved from the 6-10 year and 11-15 year maturity buckets, with a bit from the 1-5 year bucket as well. Therefore, most of the 39 loans would have seen a 10-14 year maturity extension.

Overall, this maturity extension of the ChEXIM loans to 16-20 years means it falls right within the 2040-2044 period, with the government having earlier said bilateral lenders have agreed to extend maturities up to around 2042.

In the coming months we will also see other bilateral lenders completing these administrative procedures for finalizing the bilateral restructuring on lines similar to what ChEXIM has done.

But this is not the end of Chinese debt restructuring for Sri Lanka!

As highlighted multiple times, there is still no information on the progress for restructuring the China Development Bank (CDB) loans to Sri Lanka. There is likely about $3bn in CDB loans which are considered commercial debt and would likely be restructured in a manner comparable to the NPV loss taken on the ISB restructuring. However, the ongoing delays on finalizing the ISB restructuring, might be delaying the CDB progress as well. Or vice versa. Who knows.

If you are looking for more information on China-Sri Lanka dynamics have a read through the Sri Lanka-China Economic Brief that I compiled with Umesh Moramudali as part of our China work with Arutha.

https://arutharesearch.org/2024/05/19/sri-lanka-china-economic-brief-issue-i/

https://arutharesearch.org/2024/08/15/sri-lanka-china-economic-brief-issue-ii/