'Financing' Sri Lanka's Current Account Surplus

And how it ended up supporting the Indian current account deficit

Sri Lanka has been running continuous external current account surpluses since 2H-2022, the reasons for which I highlighted in my previous article. These accumulated surpluses have been ~$2.9bn during the 2 years from from 3Q-2022 to 2Q-2024, and even higher at ~$5.3bn when you exclude the accounting entries for the accrued interest arrears (unpaid interest) on the defaulted debt.

Sustained current account surpluses lead to subsequent changes in the external liabilities and assets of the country. The surplus has to be ‘financed’ - that is used in paying down liabilities and/or accumulating assets. The headline development here has been the increase in foreign assets held by the Central Bank. But there is also an increase in the foreign assets accumulated by the domestic banking system. Inherently, a surplus country is going to end up financing deficit countries. This was anecdotally shown very clearly in a recent news item.

Sri Lankan lending to India!

Sampath Bank, one of the largest domestic privately owned banks in Sri Lanka, announced that it had essentially lent money to the State Bank of India (SBI) - one of the largest state-owned banks in India. Sampath Bank participated in the issuance, contributing around $25mn (as reported by EconomyNext) of the $ 750 million senior unsecured syndicated term loan facility for the State Bank of India (SBI), facilitated by Mashreq Bank. SBI was initially hoping to issue $350mn in this issue, but widespread interest prompted upsizing to $750mn by the time it was completed at end-July (as reported by Indi’a Business Times). Syndicated loans are where a group of different banks come together to lend to a borrower, reducing the individual banks exposure.

SBI was among the Indian financial institutions that supported emergency financing to Sri Lanka during the 2022 economic crisis, providing a $1bn import credit facility of which about half was used by Sri Lanka. Sri Lanka was accumulating foreign liabilities at the time to finance the external debt repayments and current account deficit it was still experiencing. One could also argue that the availability of financing facilitated the current account deficit at the height of the economic crisis at a point where most other forms of financing was unavailable.

Now with Sri Lanka running a current account surplus for the past 2 years, paying down liabilities (including to India) and accumulating assets, a Sri Lankan bank is helping finance the Indian current account deficit through lending to one of India’s largest banks. Life comes full circle!

There is a limit to how much liabilities can be paid down

Over the past two years we have seen the Sri Lankan banking sector paying down a big part of its external borrowings. But as the current account surplus continued, there were more FX balances left in the banks than could be used for paying down external debt. This meant an increase in the foreign assets held by the banking system, in addition to the foreign assets held as reserves by the Central Bank.

(Important note - when this article refers to foreign assets and liabilities, it only refers to those assets of and liabilities due to non-residents. That is those not resident in Sri Lanka whether they are individuals, firms or other institutions. Sri Lankan banks do have foreign currency assets and liabilities of and due to those resident in Sri Lanka as well. Those are not covered here since the article is only looking at foreign assets and liabilities as referred to in the IIP dataset.)

The International Investment Position (IIP) data shows that the foreign liabilities of the Sri Lankan banking sector has been falling consistently since 3Q-2021 from $7.4bn to ~$5bn in 1Q-2023. A reduction of about $2.5bn. However, there was a shift in the foreign liability make up even before 3Q-2021.

After 2020 the quantity of short-term foreign loans reduced from ~$4bn to just $275mn by 2Q-2024. Long-term foreign loans were also reduced from ~$1.5bn to $441mn. Overall, the banks’ foreign loan liabilities reduced by ~$3.8bn over the 3.5 years, with not much further space to use the surplus to pay down bank foreign loans.

Counteracting part of this, foreign currency & deposit liabilities increased from ~$1.1bn in 3Q-2022 to just over $4bn since late 2021. Part of this could be an increase in rupee deposits held by non-resident Sri Lankans in local banks during the economic crisis. Another factor could also be the attractiveness of FX deposit rates of Sri Lankan banks.

Figure: Foreign Liabilities of Sri Lankan Banking sector

(technically all depositing taking institutions, but non-banks have little foreign assets & liabilities)

The foreign asset accumulation to keep up with the surplus

Initially in 2023 most of the foreign assets were in the form of deposits accumulated in foreign banks. But from late-2023 onwards there was an increase in allocation to other forms of foreign assets including investments in foreign debt securities and loans. The decision by Sampath Bank to invest in SBI’s syndicated loan issuance is part of that.

The IIP data shows that Sri Lankan banks saw jumps in their foreign assets during mid-2021, across 2022 and in 3Q-2023. Overall, the total foreign assets doubled between 1Q-2021 and 3Q-2023 - around a ~$2.5bn increase (similar to the reduction in foreign liabilities). About $1.5bn of this was in the form of currency and deposits. The rest is classified as other accounts receivable in the IIP data, which might also imply being invested in some form of deposit or short-term instrument. The CBSL’s 2024 Financial Stability Review does note that by 2Q-2024 banks held about $3.7bn as balances or deposits with financial institutions abroad.

While these other accounts receivable amounts have remained constant during 1H-2024, $332mn of the currency and deposits have been converted into investments in foreign debt securities. There were no loans held as assets by end of 2Q-2024, but the Sampath Bank investment in the SBI syndicated loan completed in July might show up as one in the next IIP update for 3Q-2024.

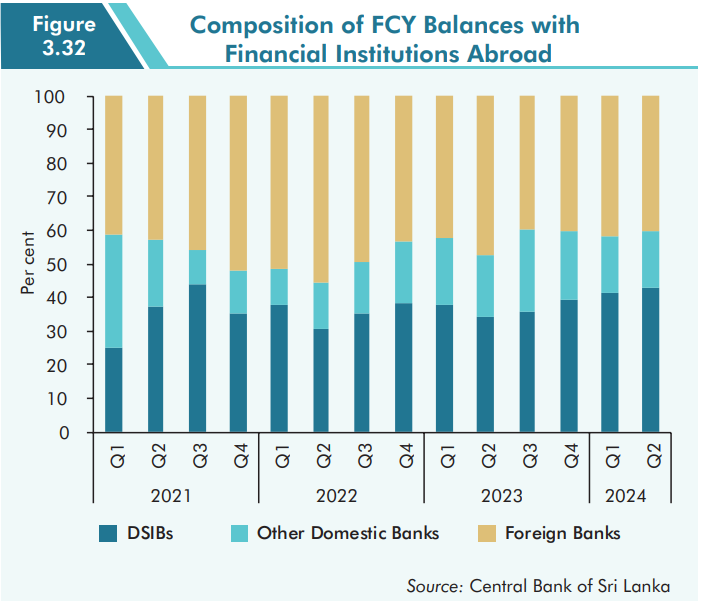

It is however important to keep in mind that the accumulation of foreign assets might not be among all Sri Lankan banks. The CBSL’s 2024 Financial Stability Review does note that DSIBs (the 4 largest domestic banks) and foreign banks hold most of the balances with foreign banks.

Also a driver behind the big jump in foreign assets of the banks in 3Q-2023 was the restructuring of Sri Lanka Development Bonds (SLDBs). These were domestic law dollar bonds that were held largely by the domestic banks as a domestic FX asset. With the restructuring they were converted into rupee bonds, reducing the FX assets held by the banks. The accumulation of foreign assets was likely needed to balance with the banks’ FX liabilities and meet FX net open position requirements.

Figure: Foreign Assets of Sri Lankan Banking sector

(technically all depositing taking institutions, but non-banks have little foreign assets & liabilities)

Net Foreign Assets of Banks show a slightly different picture?

In a separate dataset on monetary aggregates, CBSL reports the net foreign asset (NFA) position of the banking sector was a positive $1.3bn by June 2024. But the difference in the foreign assets and liabilities in the IIP data is only a positive ~$300mn net foreign asset position.

The total reserve assets figure reported by CBSL, which includes foreign reserve assets of CBSL and the banking sector, can be used to show that by June 2024 the banks’ foreign assets was ~$5.1bn. In line with the foreign assets shown in the IIP. Therefore, its likely that the foreign liabilities used in the NFA calculation is lower by ~$1bn than what’s shown in the IIP. Part of this could be the rupee deposits of non-residents and differences in how certain balances abroad might be reported in the two datasets.

Figure: NFA & Net IIP give two different pictures on net assets of banks but similar trend of improvement regardless

Anywhere else the current account surplus has seeped into?

The obvious place where this has happened is the CBSL’s foreign reserve assets, which increased in usable form from near zero in April 2022 to $4.5bn by Sept 2024.

Part of this was enabled by CBSL purchasing FX in the domestic FX market, with net purchases of about $3.7bn from July 2022 to June 2024. This accounts for about 70% of the $5.3bn in accumulated current account surplus (when excluding accrued interest arrears).

According to the IIP data, there has also been changes in the net foreign asset balance sheets of the other sectors (private sector and SOEs) beyond the govt, CBSL and banks. The Other sectors have also seen a paying down of foreign debt liabilities with regards to long-term loans and trade credit, amounting to a reduction of ~$2.1bn since mid-2022 and ~$3.3bn since mid-2021. The other sectors have also increased the amount of trade credit granted to foreigners (which is a foreign asset for the other sectors) by about ~$400mn and ~$700mn, respectively, since mid-2022 and mid-2021.

Does all this have an implication on Sri Lanka’s future current account balances?

Countries like Japan and Taiwan which have had long run current account surpluses are in a situation where their financial and corporate sectors have accumulated significant amounts of foreign assets over a long period of time. This has meant that these countries receive a significant amount of interest, dividend and other incomes from these investments. These are recorded in their current account, so even when they are export earnings are stagnant, these other foreign incomes can help keep their current account balances in larger surpluses or smaller deficits, than would be otherwise the case.

Of course, Sri Lanka is not in such a situation. Since mid-2022 the increase in foreign assets accumulated by the CBSL, banks and other sectors are only about $6bn. So, the foreign income from that is not going to be very significant for the country as a whole, though for individual banks or firms it can be significant in rupee terms. Current account data shows an increase in investment income driven primarily by foreign interest income of commercial banks’ and CBSL on their increased foreign assets. In reaching ~$100mn per quarter from late-2023 onwards, this is the largest such foreign investment income going back to 2012, and goes well in line with higher US interest rates since the foreign assets held are likely to be US Dollar denominated ones.

One way the current surpluses can matter to future balances is how the foreign assets accumulated so far are used in the coming years. Just like incurring foreign liabilities can be used to finance a current account deficit, selling down foreign assets can also be used to finance a deficit. Another way is whether the reduction in external indebtedness of the banks and firms in the current period, having paid down a lot of external liabilities, allows increased access to foreign borrowings in the future.

Disclaimer - All of this is my own analysis and opinions. None of this involves any investment recommendations or advice. Any errors and omissions are my own. It is likely that there are issues/errors in the data, even though I have pre-dominantly used official data sources.