Sri Lanka's 2023 balance of payments & $2.5bn reserve accumulation

Comparing actual BOP numbers available to the IMF program assumptions

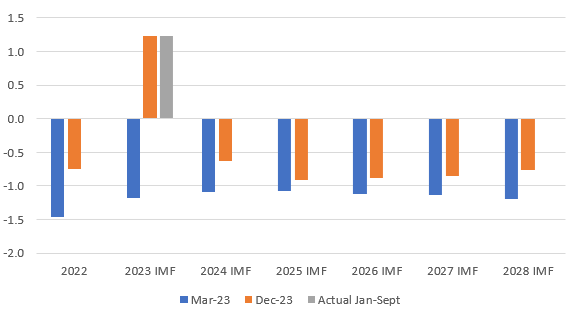

While the IMF provided an updated balance of payments projection for 2023 to 2028 for Sri Lanka in its staff report for the first review in December 2023, Sri Lanka’s actual external sector seems to be performing better than expected by the IMF staff.

A significant $1.2bn current account surplus in 9 months

A major overperformance is on the current account surplus. The Dec 2023 IMF report assumption is for a $1232mn surplus for the whole of 2023. But in the Jan-Sept period alone, Sri Lanka recorded a $1231mn surplus. With remittances continuing to be high, tourism recovering into the winter tourism season, and imports still contained, the current account surplus is likely to expand in the last quarter, making it higher than projected by the IMF staff in December.

Figure: Current account balance projection by IMF staff, % of GDP

Current account balance includes the interest payments on defaulted external debt that are accrued as arrears. The accrued interest in arrears amounted to $709mn in 2022 and $866mn in Jan-Sept 2023. This amount is simply an accounting entry. Sri Lanka does not pay the interest, its simply entered as an outflow in the current account and balanced off by entering it as an inflow in the financial account. This means that the current account surplus in the Jan-Sept 2023 period excluding the accrued interest would be about $2.1bn.

Figure: Current account balance components Jan-Sept 2023, $ billion

A significant part of the current account surplus, as opposed to the $1.2bn deficit projected for 2023 by the IMF in March 2023, has been the contained imports. With private sector credit growth recovery being sluggish, real incomes depleted by inflation and disposable income reduced by higher taxes, consumption and investment remains weak. Monthly non-fuel imports have remained at levels last seen in 2010/2011, indicating this weakness.

Figure: 3-month rolling average monthly imports, $ million

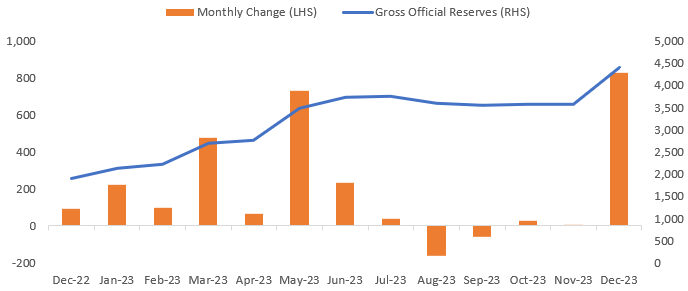

Reserves jump in December

According to the CBSL, its forex reserves increased to $4.4bn by end-2023, a rise of about $2.5bn during the year, and a rise of $829mn in December alone. This clearly puts Sri Lanka’s reserves above the 3-months of merchandise imports coverage ratio and was in line with the $2.5bn increase expected by the IMF in its March 2023 staff report. But significantly higher than the $1.9bn increase assumed in the latest Dec 2023 update.

Figure: CBSL Forex reserves increase projection by IMF staff, $ billion

The large reserve increase in Dec was driven by the disbursement of funds by multilateral agencies following the IMF 1st review, with over $800mn in disbursements from IMF, ADB & World Bank.

Figure: CBSL Forex Reserves, $ million

Significant external asset accumulation by banks as well

In the Jan-Sept period, Sri Lanka also obtained $1772mn in net inflows (accounting for principal repayments) by incurring external liabilities - loans, FDIs, portfolio inflows. Of this $866mn was the accrued interest in arrears, leaving $906mn in actual net inflows. Combined with the current account surplus exl the accrued interest, Sri Lanka thereby had about $3bn in inflows, that was balanced by acquiring $3bn in net external assets - $1678mn by the CBSL’s forex reserve accumulation and the rest by the banks and private sector.

The banks’ external asset accumulation actually played a significant role in why Sri Lanka struggled to build up reserves further during the July to November 2023 period, stagnating around the $3.5-3.6bn range. With the restructuring of foreign currency govt debt, including SLDBs and dollar loans, domestic banks had to narrow their FX net open positions (difference between their FX assets and liabilities). These needs heightened in 3Q-2023 when the govt’s dollar SLDBs were restructured into rupee T-bonds in Aug 2023.

Using the International Investment Position (IIP) data its possible to see that the financial sector increased external assets by about $1.2bn in Jan-Sept 2023, with about $850mn happening in 3Q alone.

Figure: Quarterly Change in External Assets of Financial Sector, $ million

Multilateral inflows play a critical role in external balances

According to the External Resources Department of the MoF, the government received $1.59bn in loan disbursements from external creditors during Jan-Nov 2023. Of this $1.39bn are from the IMF, World Bank and ADB, with about $50mn from other smaller multilateral lenders (OPEC Fund, Intl Fund for Agri Dev, and AIIB) and the remaining $165mn from a few bilateral linked lenders (EXIM India, State Bank of India, Govt of France, Co-op Centrale Raiffeisen Netherlands, Saudi Fund). With around $900mn in multilateral inflows coming in December, overall loan disbursements are likely about $2.5bn in 2023.

Figure: Estimated Disbursements & Repayments on Multilateral & Indian debt for 2023, $ billion

The IMF’s Dec assumptions were for $682mn in IMF and $1220mn in other multilaterals’ budget support financing, a total of $1.9bn. So, the rest of the external financing from multilateral and bilaterals are for project financing. But overall external disbursements in 2023 of around $2.5bn would be significant lower than expected at the start of the IMF program (about $3.7bn) in March, partly due to the delays in progress on external debt restructuring as noted in the IMF’s Dec 1st review.

While the commercial debt and most of the bilateral debt is in default with no repayments happening, the multilateral debt and Indian emergency credit lines continue to be repaid. With the increased reliance on new multilateral debt, repayments on multilateral debt, including to IMF, has been rising to about $1.15bn in 2023. So, a substantial portion (40-50%) of the multilateral disbursements flow out for meet debt repayments to them. The ERD also expects repayments on the Indian credit lines to be about $560mn in 2023, indicating a total repayments of $1.7bn in the year (closer to $2bn when CBSLs swap repayments are factored in as well).

The IMF expects bilateral and multilateral loan disbursements to be about $2.7bn in 2024, dominated by multilaterals once again. But repayments in 2024 by the government can be estimated to be around $1.8bn (depending on final debt restructuring arrangement) and a further $1.1bn by the CBSL, largely on account of the restructured Indian swap I discussed last month. The disbursements finance the repayments due.

But the question is whether the Presidential election in October 2024 would cause delays in finalizing the 3rd IMF review currently scheduled to be in October 2024 as well. If the review does get delayed on account of the election and any potential changes in policy post election, then multilateral disbursements due alongside the review might not get disbursed. Continuing to maintain a current account surplus in 2024 (contrary to IMF projections) would provide an external buffer to Sri Lanka for such a risk, similar to how it did with external loan disbursements being lower than expected in 2023.

Note: The data used in this article are based on data available as of early Jan 2024. This includes Jan-Sept 2023 BOP data, ERD data via RTI as of end-Oct, ERD disbursements data as of end-Nov, and latest CBSL reserves estimate for end-2023. Actual numbers for overall 2023 via BOP data will take till early April to be released and there can be changes with data updates and revisions in the coming months.