Diversification of Sri Lanka’s Remittance flows – in source & form

Remittance flows amount to about 6-7% of GDP & 20-25% of FX earnings

Sri Lanka’s foreign exchange inflows are primarily driven by three key sectors: exports, tourism earnings, and worker remittances. Since 2024, the country has maintained a current account surplus in most periods, with only two exceptions. This improvement has been supported not only by continued import controls and vehicle import restrictions but also by a notable increase in remittance inflows.

Despite a gradual pickup in imports during 2024 and 2025, Sri Lanka has managed to sustain its current account surplus, which also helps to stabilise the dollar-rupee exchange rate. Remittances, in particular, have played a long-standing and vital role in the country’s foreign exchange market, dating back to the 1960s. Over the decade, the nature of labour migration and the composition of remittance flows have significantly evolved, providing deeper insights into their macroeconomic impact.

This analysis will examine migration and remittances through the lens of the Balance of Payments (BOP), highlighting their continued importance to Sri Lanka’s external and overall economic stability.

Remittance earning performance and BOP

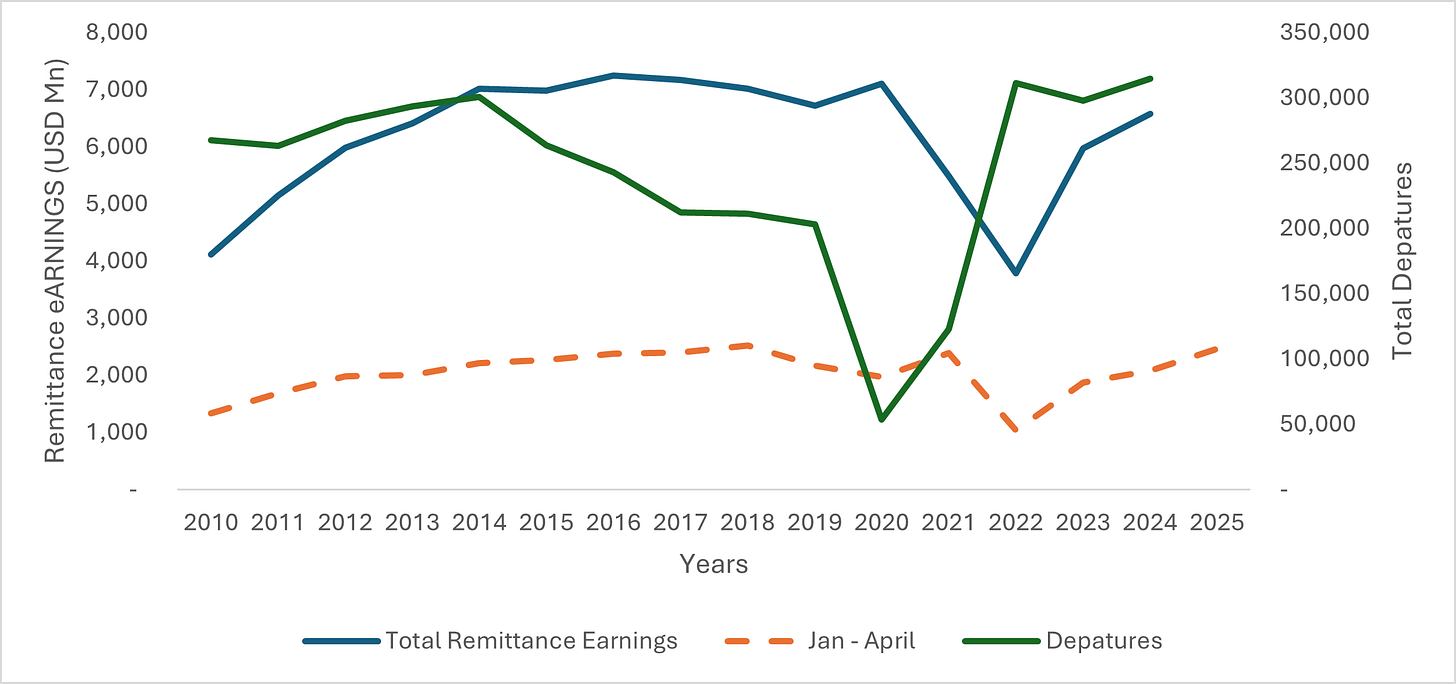

Performance of Net Remittances (USD Mn)

Worker remittances have played a crucial role in supporting Sri Lanka’s economy, particularly in managing the current account balance. This trend is especially evident in the monthly current account data for 2025. For instance, in April 2025, the trade deficit widened due to a surge in vehicle imports. However, the strong performance of service inflows and robust remittance earnings enabled the country to maintain a current account surplus despite the trade gap.

Historically, remittances peaked in 2016 and 2017, reaching USD 7.2 billion, the highest on record. However, this figure declined significantly during the COVID-19 pandemic and the subsequent economic crisis. In 2022, remittance inflows fell to USD 3.8 billion, partly due to an increase in the use of informal channels such as hawala, driven by the more favourable black-market exchange rate.

Since 2023, remittance earnings have shown a strong recovery. During the first five months of 2025 (January to May), Sri Lanka recorded USD 3.1 billion in remittances. If this upward trend continues without major external shocks, the country is on track to achieve USD 7.4 billion in remittance earnings for the year 2025, potentially the highest remittance earnings recorded in over a decade.

Rising Migration and Strong Inflows Position Sri Lanka for a New Remittance Peak

1Migration Trends and Remittances.

The above chart offers a comprehensive view of the performance of Sri Lanka’s labour migration and remittance inflows. The trend indicates that remittance earnings have rebounded to pre-COVID-19 and pre-economic crisis levels, suggesting a gradual return to economic normalcy. During the first five months of 2025 (January–May), remittance inflows grew by 18% compared to the same period in 2024 and by 32% compared to 2023. This strong recovery somewhat implies that remittances have reached a peak when looking at historical numbers. However, in 2024 total departures for foreign employment reached 314,786, the highest annual figure recorded in the past decade. This indicates the possibility for earnings from remittances to further grow beyond the historical levels. Furthermore, CBSL further states that workers’ remittances are expected to increase steadily in 2025 and beyond, helped by the momentum in foreign employment departures and increasing adoption of formal channels for money transfer by the migrant workers.2

As seen in the chart, end of Sri Lanka’s 30-year conflict and the post-war economic boom initially led to a slowdown in labour migration. However, the period between 2022 and 2024 saw a significant rise in migration, driven by economic and political instability. The sovereign default, soaring inflation which reached to 75%, and a series of tough but necessary economic reforms, including higher personal income taxes, increased VAT, and import restrictions severely impacted household living standards, prompting many to seek employment abroad.

By early 2025, there has been a decline in labour migration compared to the 2022–2024 (January–April) period. However, current migration levels still remain significantly higher than during the relatively stable 2015–2019 period. Given this backdrop, there remains potential for Sri Lanka to expand its remittance earnings beyond the current peak, although the extent of this growth will depend largely on future migration trends and global labour market dynamics.

Shift from Domestic Workers to Skilled Professions

Departures based on the skill breakdown

Since 2015, Sri Lanka’s labour migration has undergone a notable structural transformation. Prior to 2010 and even in the years that followed, approximately 40%–42% of migrant workers were employed as domestic workers, primarily in Middle Eastern countries. However, post-2015 data reveals a gradual but significant shift toward skilled migration.

By 2024, the share of domestic workers among total migrant departures had declined to around 30%, while skilled workers accounted for approximately 35%. This shift marks a structural change in the composition of Sri Lanka’s labour migration, indicating a growing preference for more specialised roles abroad.

Moreover, professional-level migration has shown a steady upward trend since 2018. In 2010, only about 1% of outbound labour was classified as professional. By 2024, this figure had increased to 7.1%, reflecting the increasing global demand for Sri Lankan professionals and a rising skill base among the workforce.

This shift has important yet negative implications for the domestic labour market. As highlighted in one of my previous articles, there has been a noticeable outflow and retirement of highly skilled professionals, particularly from the public sector, leading to a growing skills gap within the country. This trend can also be observed within the private sector. Addressing this vacuum should be a priority for policymakers. Ensuring the availability of an efficient and skilled labour force, alongside productive capital, is essential for sustaining long-term economic growth.

From Middle East Dependence to a 50/50 Remittance Base

3Remittance Earnings – Country-wise breakdown

The chart clearly illustrates the regions from which Sri Lanka derives the majority of its remittance inflows. An interesting observation between 2023 -2024 shows that remittance earnings, which came through North America, have increased approximately by 200%, which provides us an understanding that remittances that is coming from Canada and the USA are slowly increasing. Between 2012 and 2020, the country's external sector performance and foreign exchange earnings were heavily reliant on the Middle East, which accounted for approximately 45% to 50% of total remittance inflows. This high dependency also aligns with the labour migration profile during that period, where a significant share of remittances came from domestic workers employed in the Middle East. This correlation highlights how Sri Lanka's remittance-driven forex inflows were largely dependent on a specific skill group and region.

Middle East vs rest of the world performance

However, recent data suggests that this pattern is beginning to shift. The country is now witnessing a more diversified remittance base, both in terms of geographic sources and the skill levels of migrant workers. As the chart depicts, Middle Eastern countries and the rest of the world are now contributing 50%-50% for remittance earnings.4 The dip in the chart is mainly due to the calculation method revised by CBSL.5 This structural evolution reflects broader changes in labour migration trends and offers opportunities to build a more resilient and sustainable remittance inflow system.

As illustrated in the chart above, there has been a notable shift in the regional composition of Sri Lanka’s remittance earnings. By 2024, around 50% of remittances originated from countries outside the Middle East, indicating a growing diversification in source regions. Nevertheless, the Middle East still accounts for the other 50% share of total remittances, highlighting continued dependence on that region.

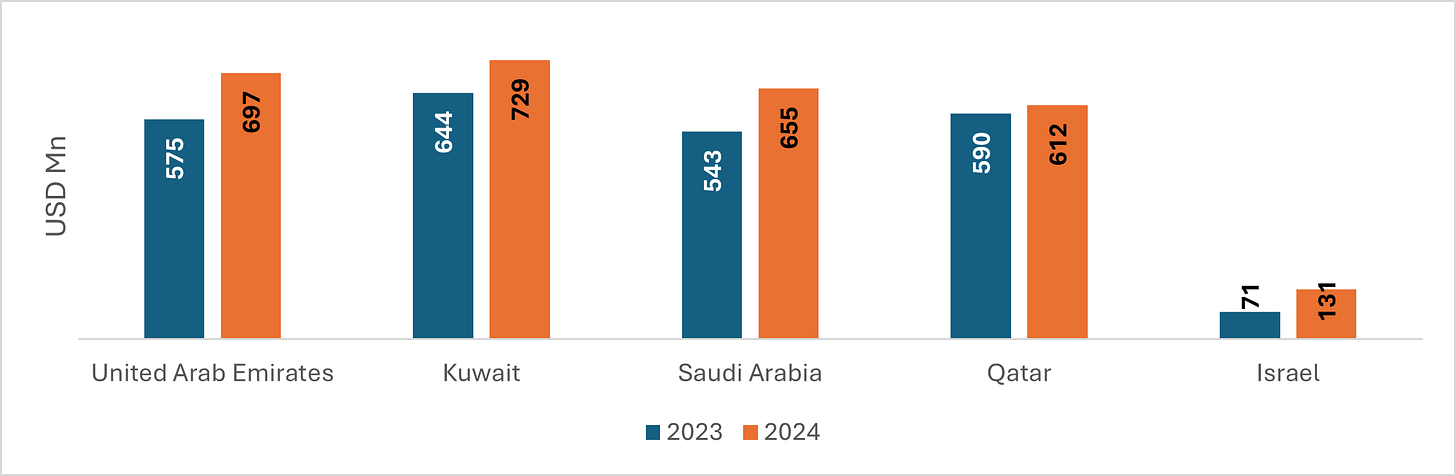

Middle Eastern Region: Highest Contributing Countries

Rest of the World: Highest Contributing Countries

The above analysis reveals a significant observation: Sri Lanka does not rely on any single country for remittance earnings. Instead, both Middle Eastern countries and other regions contribute almost equally to the overall inflow, indicating a well-diversified source of remittances.

This reliance is particularly important in the current context of escalating geopolitical tensions between Iran and Israel. As of 2024 only 2% of our remittance earnings originated from Israel. However, any disruption in the Middle Eastern labour markets due to conflict or instability could pose risks to Sri Lanka’s remittance inflows. Given the critical role remittances play in supporting the country’s external sector and current account, this emerging risk underscores the need for proactive monitoring and policy preparedness.

Disclaimer: The views expressed are solely those of the author and do not represent the opinions of any organization the author is currently or previously affiliated with. The author assumes full responsibility for any errors or omissions.

The term “departures” mentioned here refers only to those officially registered with the Foreign Employment Bureau. However, some individuals may not have registered but can still send remittances to the country.

https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/publications/aer/2024/en/09_Chapter_04.pdf

For the country-wise breakdown, the author has utilised statistics from the Central Bank of Sri Lanka (CBSL) and the Ministry of Finance (MOF). For 2023 and 2024, the author has included the Global component (e.g., Western Union, RIC, etc.) under the "Other" category, since the CBSL does not indicate the origin of these earnings. MoF data appears to mislabel this entirely as South and Central America.

Under the assumption that records under the “global” category are split equally between these two main country categories.

Under the “global” category, there is no country-wise breakdown. They could be sourced from Middle East or other regions

Hi - with labour migration diversifying and possibly getting skewed further towards the skilled category, going forward do you think there will be a risk of remittances declining? Reason being most often skilled labour migrate with their immediate family, so there is a lesser need to remit funds to SL. On the other hand, most low skilled labour leave their families behind and go, hence they tend to send back a higher percentage of their earnings. Keen to hear your thoughts.