Sri Lanka's post-crisis lending boom

The extent and form of private sector lending expansion in 2025

2025 saw significant expansion in bank lending to the private sector, quite higher than what was expected at the start of the year. The contraction in lending immediately following the 2022 crisis and the stagnant growth in 2024 finally gave way to a sustained expansion by mid-2025. The focus of this article is the lending to the Sri Lankan private sector (firms and individuals resident in Sri Lanka), falling within domestic credit category of the CBSL’s M2b data. In addition to this domestic lending, the banking sector has also increased its investment and lending activities to non-residents, increasing foreign assets well before the ongoing domestic lending boom.

Switching back from Foreign Asset to Domestic Asset accumulation

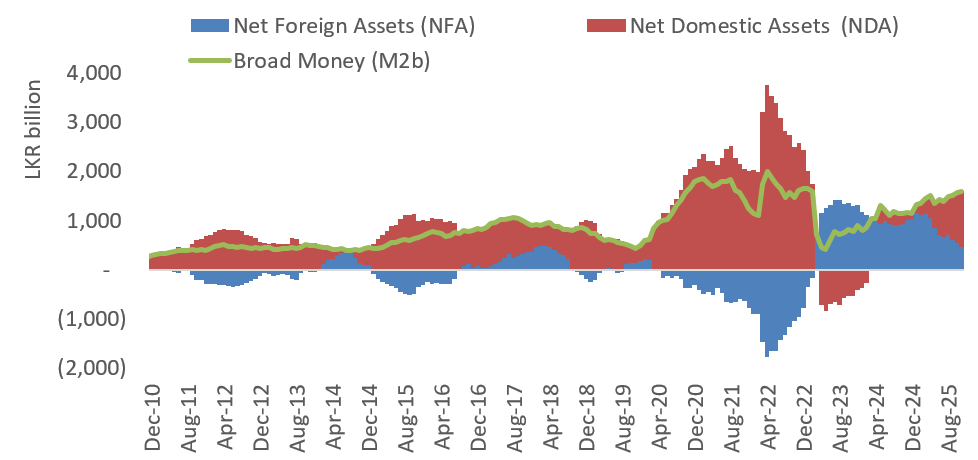

Broad Money (M2b) expanded by 11.3% YoY or almost LKR 1.6 trillion for the 12 months to Nov 2025.

12 month rolling growth in M2b Broad Money, LKR billion

In the run up to and during Sri Lanka’s 2022 crisis, there was a massive increase in domestic asset creation as the banks and CBSL lent in significant amounts to the government in particular amidst high fiscal deficits. At the same time net foreign assets contracted, especially as CBSL foreign reserves were used up and swaps were obtained. But from mid-2022 onwards, the domestic banking system started to paydown its foreign liabilities and accumulate foreign assets using the current account surplus. As a result, net foreign asset improvement drove M2b expansion for much of 2023 and 2024. I’ve covered this shift more than a year ago.

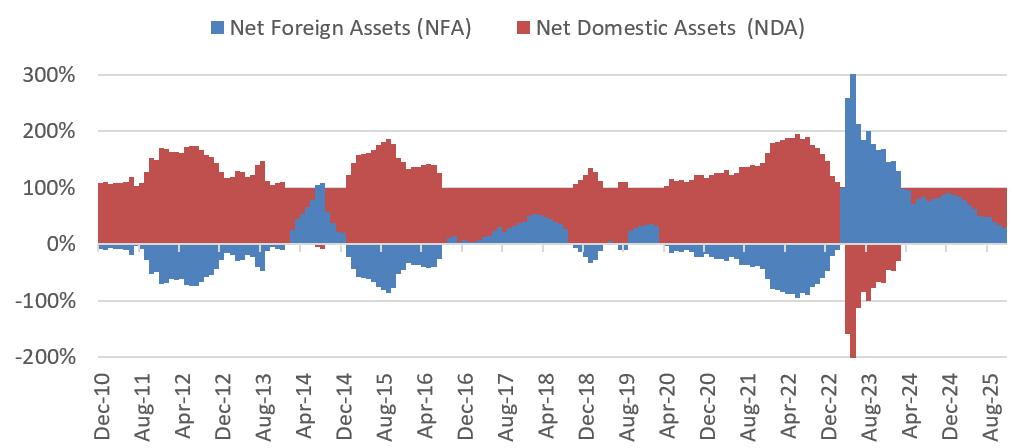

From June 2025 onwards there has been a clear shift with the expansion in M2b being driven more by the expansion in Net Domestic Assets (NDA) than Net Foreign Asset (NFA) accumulation for the first time since early 2023. But the expansion in domestic credit expansion in 2025 is different to the expansion up to the 2022-2023 crisis years.

Contribution of NFA & NDA to 12-month rolling M2b expansion, %

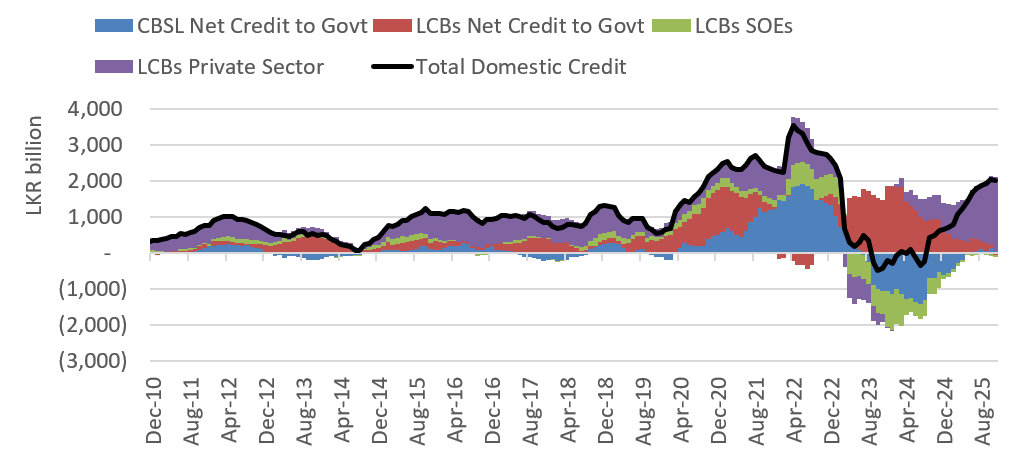

Pre-crisis, the expansion in domestic credit saw significant contribution from licensed commercial banks (LCBs) lending to the government and SOEs, alongside some periods of CBSL lending to the government. But since late-2024, the expansion in domestic credit over rolling 12-month periods has been driven by the increase in LCBs lending to the private sector (firms and individuals resident in Sri Lanka).

SOEs have actually been paying down their borrowings from the banks and the government has taken over some of their debt and CBSL lending to the government was restructured in late-2023 and repaid gradually. While bank net lending to government has not contracted (other than during the height of the crisis in mid-2022), it has been largely stagnant as government borrowing needs have reduced amidst successful fiscal consolidation.

12 month rolling growth in Domestic Credit, LKR billion

Expansion in Bank Lending to the Private Sector

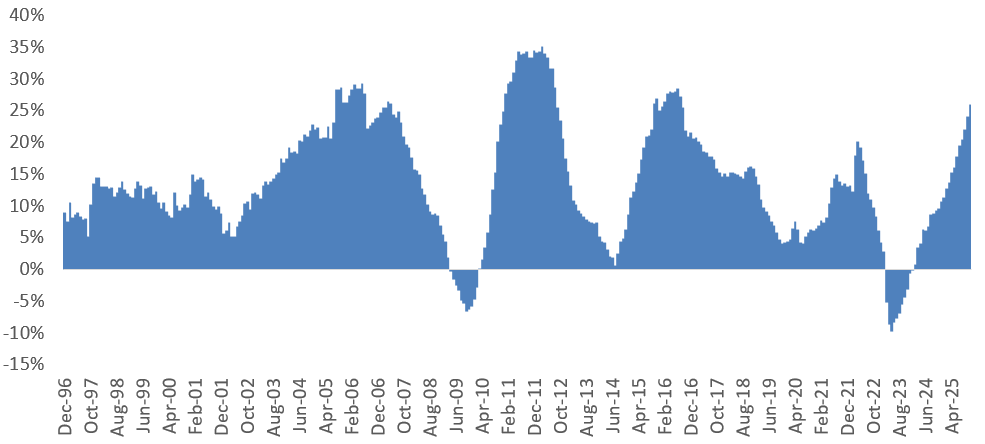

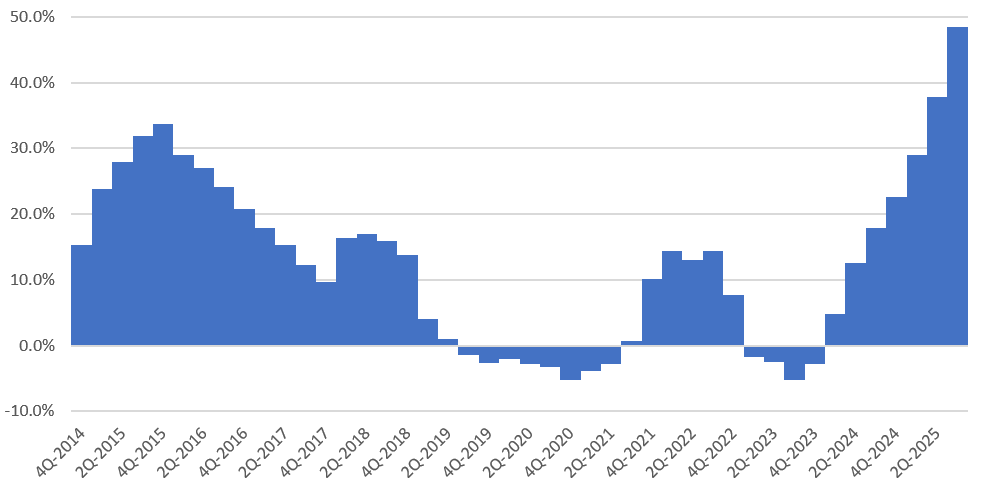

By November 2025, licensed commercial banks’ (LCBs) lending to the private sector (including individuals and households) had increased 26% year-on-year (YoY), the highest since September 2016. Since June 2025, the monthly expansion in lending to the private sector has been consistently over LKR 200 billion, for the first time since 1997 (excluding the one off increases during the mid-2022 crisis amidst rapid depreciation).

Monthly Change in Outstanding LCB’s credit to Private Sector, YoY %

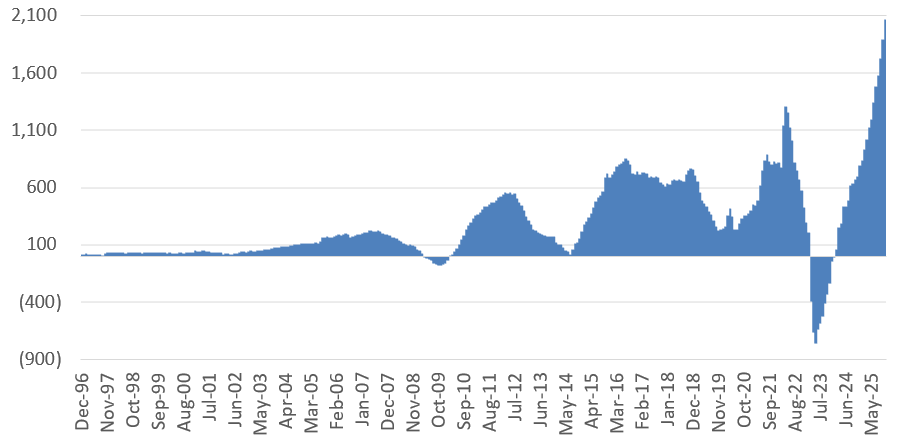

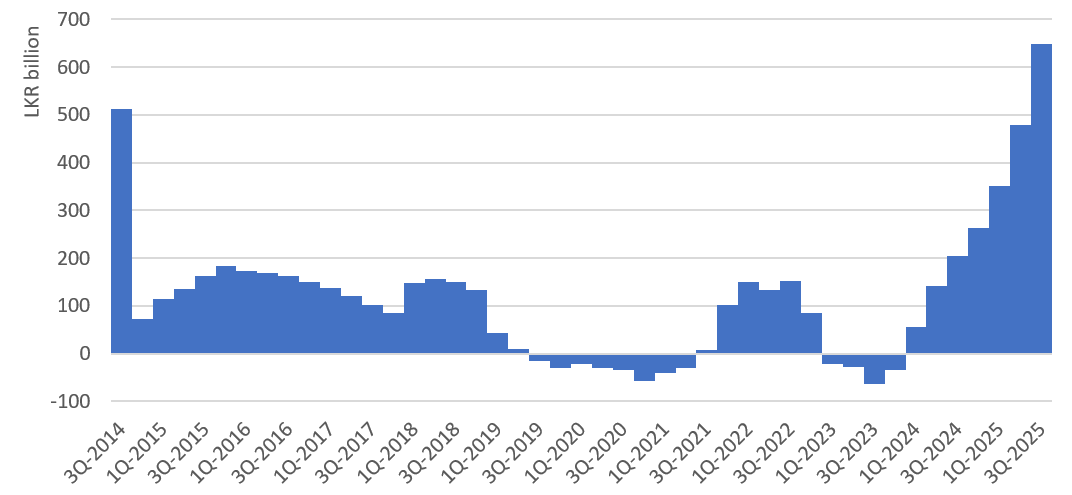

Looking at 12-month trailing sum of expansion in banking lending to the private sector it is clear that the absolute growth of almost LKR 2.1 trillion by November 2025 is the highest on record for data going back to 1996.

12-month trailing sum of growth in bank lending to private sector, LKR billion

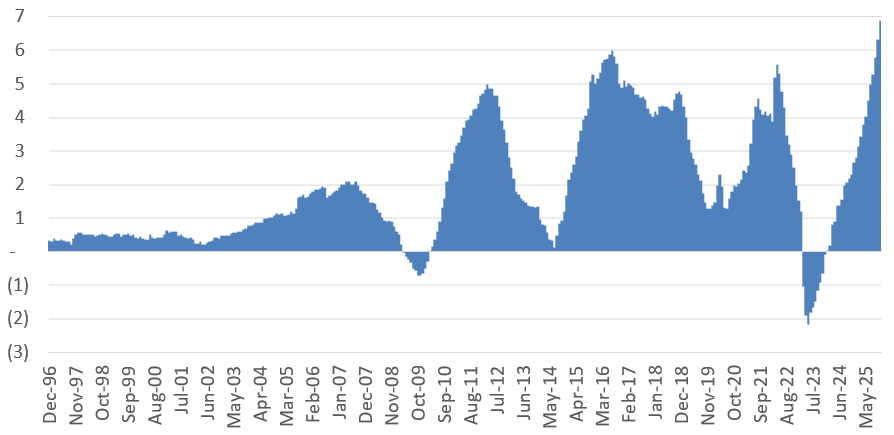

Is that really as high given the impact of significant depreciation of the currency during the crisis? Even in USD terms, the 12-month growth is the highest at USD 6.9 billion by Nov 2025, more than breaching the ~USD 6 billion peak in July 2016. Even as a share of GDP, the expansion in 2025 is likely to be around 7% of GDP, higher than the ~6% of GDP expansions in 2015-2016.

12-month trailing sum of growth in bank lending to private sector, USD billion

Where have the banks been lending to?

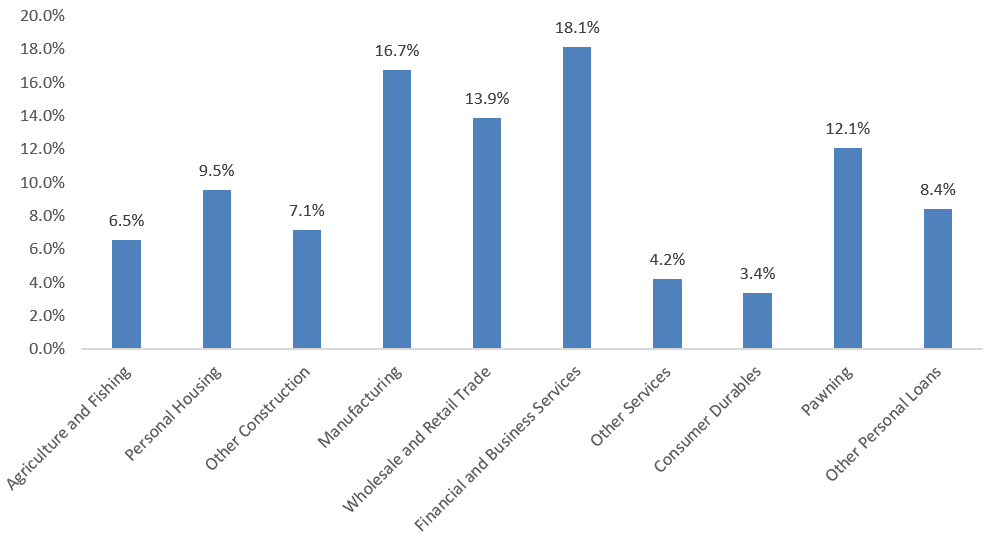

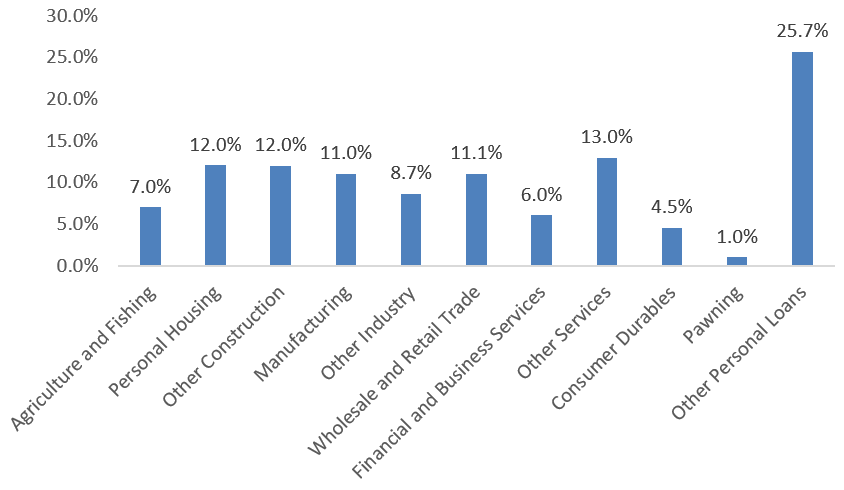

CBSL’s latest monthly sectoral breakdown of bank lending to private sector is available from April 2025 onwards. For the 6 months up to October there was about LKR 1.2 trillion in credit growth, with 18.1% of that being to financial and business services, 16.7% to construction (with 9.5% to personal housing including staff housing loans), 13.9% to manufacturing, 13.9% to wholesale and retail trade, and 12.1% to pawning. The financial and business services sector expansion might be partly due to bank lending to non-bank financial institutions (NBFIs).

Share of private credit expansion by sector for April to Oct 2025, %

Bank lending to private sector during 2016 to 2017, the last period in which there was sustained 20% plus YoY expansion, the sectors driving it were different. Construction was higher at 24% of the expansion, while personal loans - other than consumer durables and pawning - was the largest.

Share of private credit expansion by sector for 2016-2017, %

Licensed Finance Companies (LFCs) lending has also expanded significantly

Beyond the banks, the LFCs also lend substantially to the private sector in some categories such as consumer durables, especially vehicle leasing, and pawning. But their total outstanding lending was just under LKR 2 trillion at end-September 2025, compared to LKR 16.6 trillion by the banks. While the LFCs are smaller, their lending caters to a wider array of borrowers who might not have access to bank lending due to weaker financials and lack of sufficient collateral.

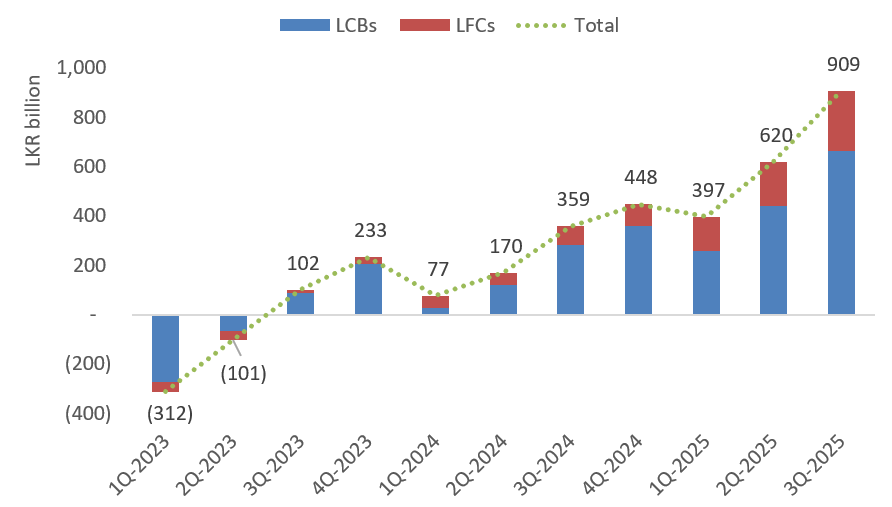

Similar to the banks, the expansion in LFC lending post crisis has been at the highest since quarterly data is available from late-2013. On a YoY basis the expansion was just under 50% and in LKR terms was just under LKR 650 billion by Sept 2025.

Quarterly Change in Outstanding LFC’s credit to Private Sector, YoY %

12-month trailing sum of growth in LFC lending, LKR billion

I would have liked to use M4 data which includes LFC and other FIs lending data. But an updated version of it is not available since late-2024.

A whole lot of balance sheet expansion

The quarterly expansion in lending by LCBs and LFCs to private sector (assuming all LFC lending is to private sector) was around LKR 900 billion in 3Q-2025. Across the period from 3Q-2023 to 3Q-2025, about 26% of the expansion in lending to private sector was driven by LFCs.

Quarterly expansion in LCB and LFC lending to private sector, LKR billion

All this lending by the LCBs and LFCs has expanded their balance sheets significantly since mid-2024. The rapid expansion of one of their major asset categories - loans to the private sector - requires financial institutions to either reduce other assets (such as investments in government securities) or expand their liabilities (deposits, borrowings or equity). The next article will take a look at how these balance sheet changes have happened over the last couple of years and whether it points to any major changes to how FIs function in an evolving economic context that is increasingly different to the past.

Note: This article is based on the personal analysis and opinions of the author. It is in no way a reflection of institutions that the author is affiliated with. Any errors or omissions are the author’s sole responsibility.